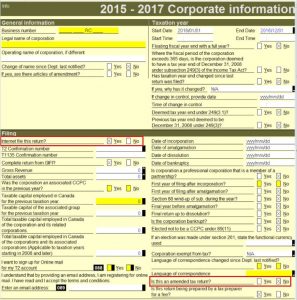

Choosing a corporation fiscal year is a decision every new corporation must make. CRA established some very basic guidelines:

- The corporation’s tax year, also called its fiscal period, cannot be longer than 53 weeks (371 days)

- For new corporations, you can declare your tax fiscal year on your first T2 return after incorporation. Make sure the financial statements you attach to the return match the tax year of the return.

- On your first T2 return after incorporation, use the date of incorporation as the tax year start. For all subsequent returns, your tax year start will be the day after your tax year-end.

Your fiscal year end is a date you must remember by heart, because your corporate tax returns due date is based on your fiscal year end.

When to file your corporation income tax return

When to file your corporation income tax return

- File your return no later than six months after the end of each tax year. The tax year of a corporation is its fiscal period.

- When the corporation’s tax year ends on the last day of a month, file the return by the last day of the sixth month after the end of the tax year.

- When the last day of the tax year is not the last day of a month, file the return by the same day of the sixth month after the end of the tax year.

Example

- If your tax year ends March 31, your filing due date is September 30.

- If your tax year ends August 31, your filing due date is February 28.

- If your tax year ends September 23, your filing due date is March 23.

When the T2 filing deadline falls on a Saturday, Sunday, or public holiday, CRA will consider the return filed on time if it is sent on the first business day after the filing deadline.